Did You Know?

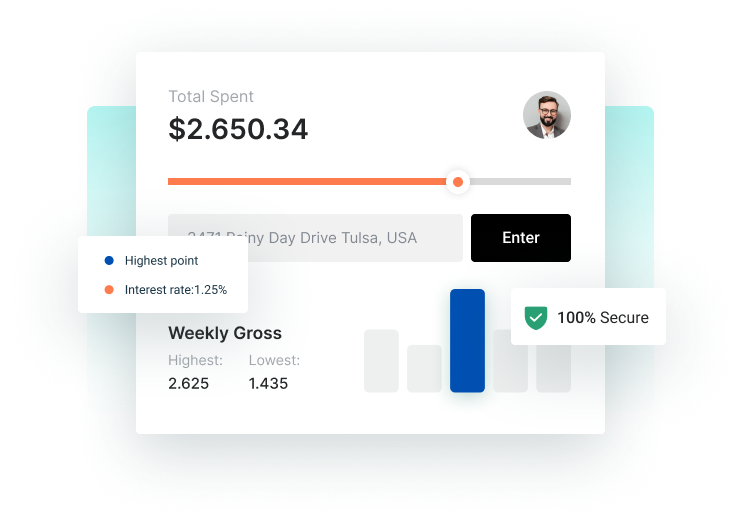

Discover a variety of Home Loan Options with flexible terms and competitive rates whether you're buying a dream home or refinancing needs.

We are cooperating with:

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form,

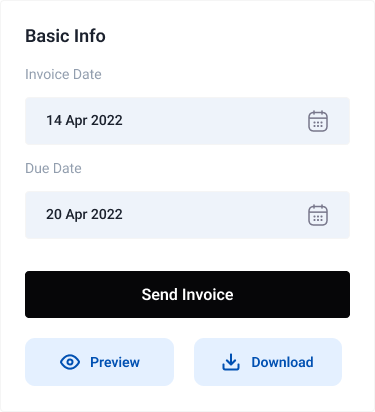

Complete your loan application online or in-person, providing all necessary documentation.

Once approved, review the loan terms and sign the agreement to finalize the process.

Receive the funds directly into your account, ready to use for your home purchase.

Discover a variety of Home Loan Options with flexible terms and competitive rates whether you're buying a dream home or refinancing needs.

Get started now

Lorem Ipsum is simply dummy text of the printing and the typesetting industry. Lorem Ipsum has been industry's

Get started now

Welcome to GOZLOAN, where we make your home ownership dreams come true with ease and simplicity. This guide will walk you through the process of applying for a home loan, ensuring you understand each step along the way.

Get started now

A vast array of institutions offer you the best home loan rates at the most competitive rates and affordable EMIs.

Home Loan Eligibility

Home Loan EligibilityThe basic home loan eligibility criteria are as follows:

Age:

Income

Employment

Credit Score

Income Proof Documents for NRI

Income Proof Documents for NRI

Basic eligibility criteria include being a legal adult, having a stable income, a good credit score, and sufficient funds for a down payment. Specific requirements may vary based on the loan type and amount.

Common documents include proof of identity, income verification (pay stubs, tax returns), bank statements, employment history, and details of your current debts and assets.

Common fees include application fees, appraisal fees, credit report fees, origination fees, underwriting fees, title search and insurance, document preparation fees, recording fees, prepaid interest, property taxes, homeowner’s insurance, and possibly private mortgage insurance (PMI).

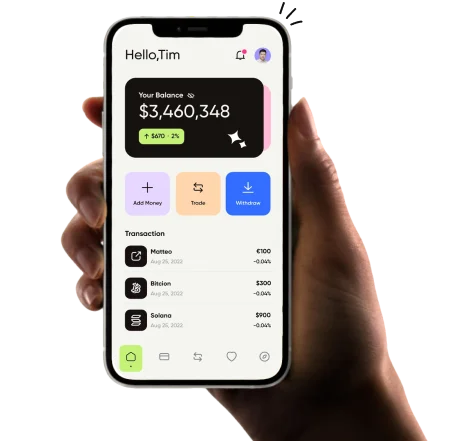

I was going through a low in my business and was unable to get financial support from lenders. Under these circumstances, Sahil from GOZLOAN suggested me to apply for a top-up home loan and use that money to fund my business. Thanks to the top-up home loan facility that helped my business to survive even in the odds.

SAMYAK SANCHETI

ArchitectI took a Home Loan for 20,00,000 from SBI via gozloan. I received a Home loan at a sparkling rate of 7.90%. Being a government employee I was offered low processing fees and other charges were minimal. I am very happy and suggest you check GOZLOAN for the best home loan options

ROHAN GAIKWAD

DsignerI got home loan offer from HDFC Limited through Ruloans. Earlier I was choosing some other bank but gozloans facility of comparison helped me with a better choice.The amount was sufficient with tenure period of 15 years. The rate of interest is moderate. I took this loan to buy an apartment. EMI need to pay 36K. Pre closure is applicable but there is locking period of 6 months. Their service is good.

JITENDRA SINGH

PHP DeveloperFirst, I used GOZLOAN emi calculator to check the approximate EMI for a home loan. I found the website very good and then I applied for a home loan with KOTAK bank from here. My loan got approved in 10 days only which is less for a home loan when compared to other home loan providers.

Anderson

Accountant

Banca is a leading bank in the worldzone and a prominent international banking institution

COTATION

2023-01-05 14:00 (INTERNATIONAL TIME)